Current compound interest rate

The calculation formula is. 125 Compounding Annually.

Accounts That Earn Compounding Interest

Daily closing balance x interest rate as a percentage 365.

. But compound interest allows you to earn interest on your principal and the interest youve already earned. During the Covid-19 pandemic the interest rate was kept at a near-zero range but has changed course as inflation has surged. Therefore the population at the end of.

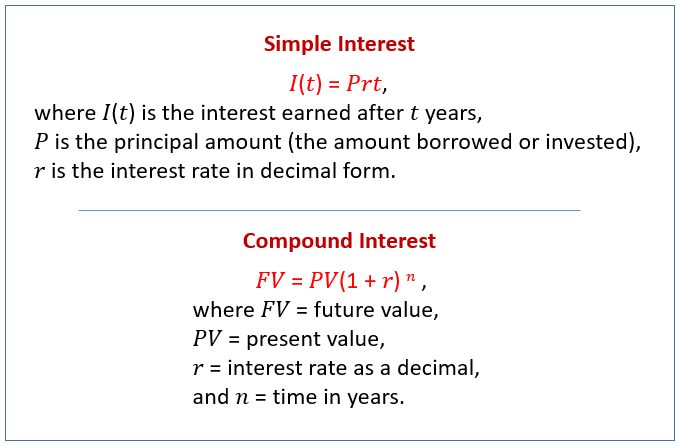

Simple Interest vs. Divide the Rate of interest by a number of compounding period if the product doesnt pay interest annually. Include additions contributions to the initial deposit or investment for a more detailed calculation.

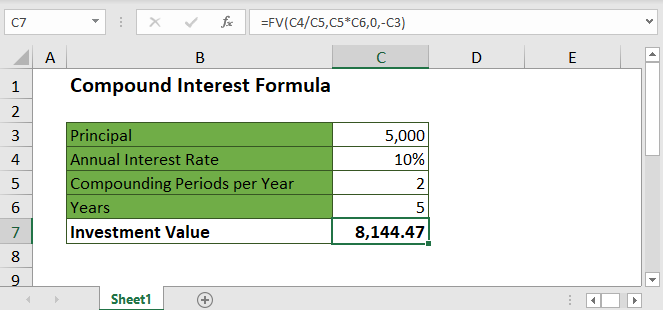

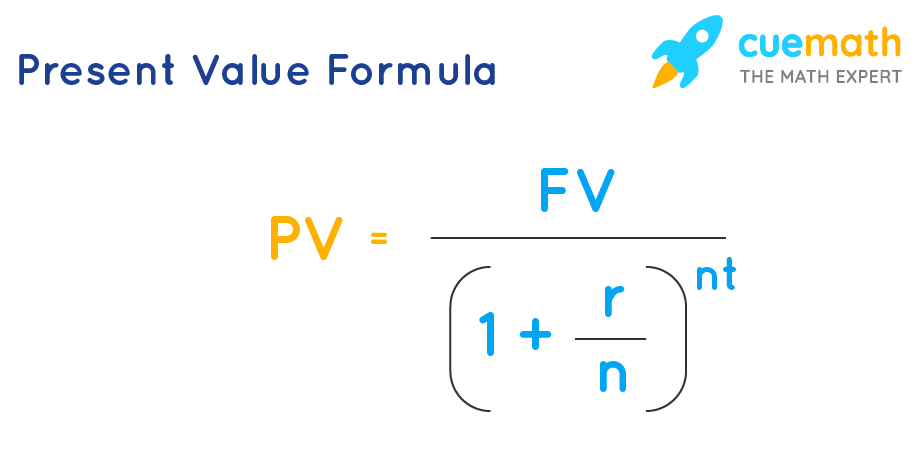

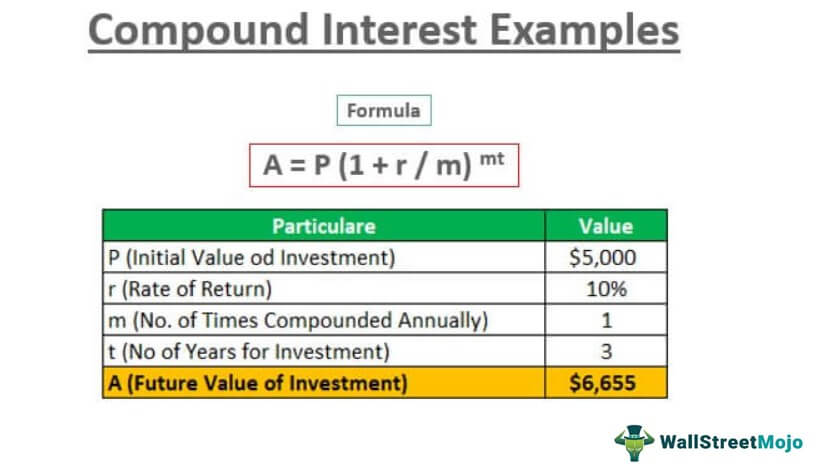

Compound interest P 1rn nt - P. Find out the initial principal amount that is required to be invested. But in the second year the amount youd earn would increase even if the annual interest rate stayed the same.

Estimate the total future value of an initial investment or principal of a bank deposit and a compound interest rate. Compound interest is interest earned on previously earned interest. The formula for the annual equivalent compound interest rate is.

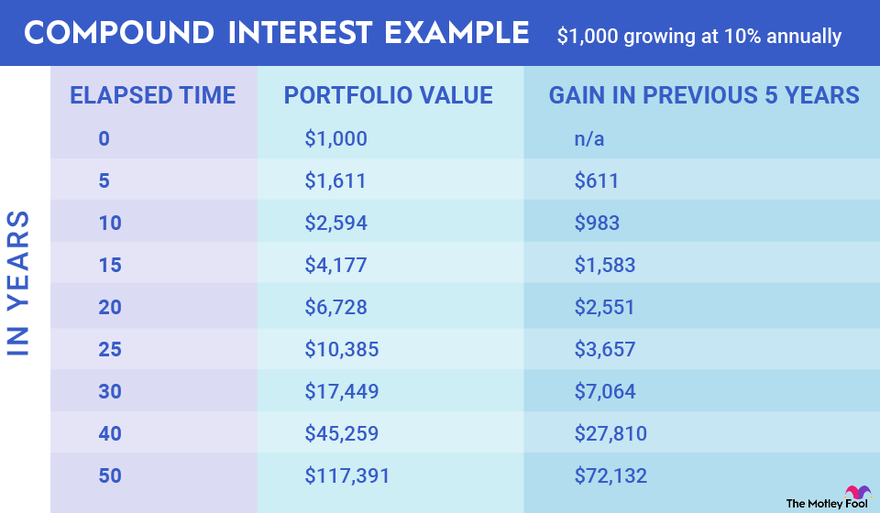

The concept of compound interest is the interest adding back to the principal sum so that interest is earned during the next compounding period. Compound interest - meaning that the interest you earn each year is added to your principal so that the balance doesnt merely grow it grows at an increasing rate - is one of the most useful concepts in finance. Compound interest may be contrasted with simple interest where interest is not added to the principal so there is no compounding.

Compound interest is the income generated from your principal investment and accumulated interest. To compute compound interest we need to follow the below steps. Amount P1 R100 t.

Thought to have. Get a weekly email of our pros current thinking about financial markets. Assume that you own a 1000 6 savings bond issued by the US Treasury.

24H Supply Volume of Suppliers. The compound interest rate can be found using the formula A P1 rn nt A Total amount P Principal r. The interest typically expressed as a.

Top 3 Markets. Understand how compound interest works and take a look at compound interest accounts on offer in Australia. Compound interest or compounding interest is interest calculated on the initial principal and also on the accumulated interest of previous periods of a deposit or loan.

Interest paid in year 1 would be 60 1000 multiplied by 6 60. Lets say you have 10000 from a lottery and want to invest that to earn more income. The effective interest rate EIR effective annual interest rate annual equivalent rate AER or simply effective rate is the percentage of interest on a loan or financial product if compound interest accumulates over a year during which no payments are made.

Real-time market data across all markets in the Compound protocol. Years at a given interest. You approached two banks which gave you different rates.

Compounding frequency could be 1 for annual 2 for semi-annual 4 for quarterly and. T is the number of years. The essential factors of calculating compound interest are principal interest rate and frequency of compounding in a given duration.

R is the annual interest rate. Compound III the next-generation protocol is now live. Treasury savings bonds pay out interest each year based on their interest rate and current value.

Premier Account Advance Account Bank Account. You do not need that funds for another 20 years. The total interest I T paid on the loan is.

The interest can be compounded annually semiannually quarterly monthly or daily. Find out how it can significantly increase your savings overtime and how it works at HSBC. Compound interest is standard in finance and economics.

It is the basis of everything from a personal savings plan to the long term growth of the stock market. Read the announcement or Try it. Compound interest is an interest of interest to the principal sum of a loan or deposit.

Compound Interest-when interest is calculated quarterly Since 1 year has 4 quarters therefore rate of interest will become th of the rate of interest per annum and the time period will be 4 times the time given in years. Savings accounts can earn interest one of two ways. To calculate compound interest annually is given by.

With simple interest you earn interest only on your principal the amount youve deposited into your account. Calculate interest compounding annually for year one. Daily Compound Interest Formula Example 2.

Thus it has a new population every year. Through simple interest or compound interest. Compound Interest Explanation.

P is principal or the original deposit in bank account. It is the compound interest payable annually in arrears based on the nominal interest rateIt is used to compare the. For the decrease we have the formula A P1 R100 n.

An interest-only payment on the current balance would be. Current page link. See how much you can save in 5 10 15 25 etc.

The hypothetical examples above were simplified in that the interest rate annual contributions and other factors were fixed over the life of the investment period. The formulas for a regular savings program are similar but the payments are added to the balances instead of being subtracted and the formula for the payment is the. In July the Federal Reserve announced that it would raise interest rates by 075 shifting the target range to 225 to 25.

So the population for the next year is calculated on the current year population. The formula is given as. Interest is the cost of borrowing money where the borrower pays a fee to the lender for the loan.

Compound Interest Calculator Daily Monthly Quarterly Annual

Present Value Formula What Is Present Value Formula Examples

What Is Compound Interest How To Calculate It

Compound Interest Examples Annually Monthly Quarterly

Compound Interest Calculator With Formula

Quarterly Compound Interest Formula Learn Formula For Quarterly Compound Interest

:max_bytes(150000):strip_icc()/COMPOUNDINTERESTFINALJPEGcopy-f248781269194135aa6044e088de7af9.jpg)

Compound Interest Explained With Calculations And Examples

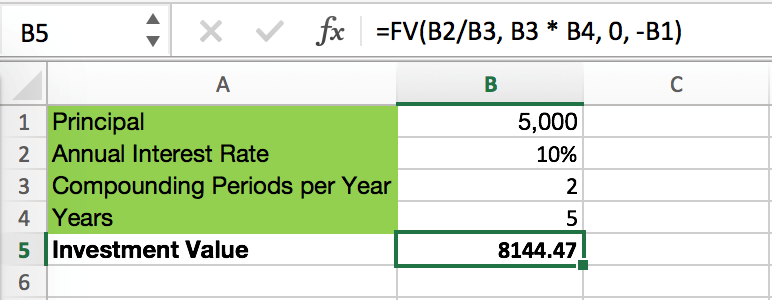

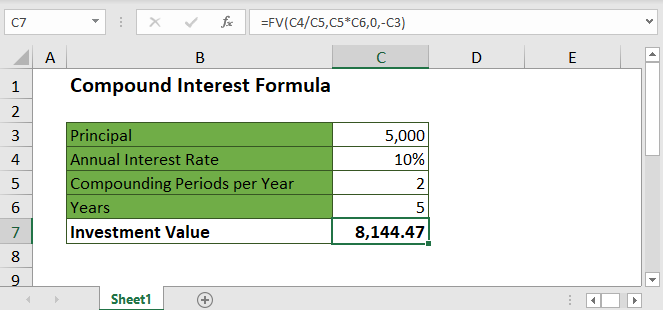

Compound Interest Formula In Excel And Google Sheets Automate Excel

Compounding Interest Formulas Calculations Examples Video Lesson Transcript Study Com

Time Value Of Money Board Of Equalization

Daily Compound Interest Formula Calculator Excel Template

Compound Interest Definition Formulas And Solved Examples

Simple And Compound Interest Examples Videos Solutions Worksheets Homework Lesson Plans

Compound Interest Definition Formulas And Solved Examples

Compound Interest Formula In Excel And Google Sheets Automate Excel

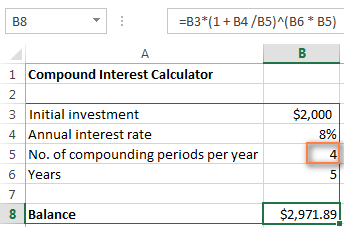

Compound Interest Formula And Calculator For Excel

Compound Interest Formula And Calculator